From my previous post, “Call Results: My Surprising Retention Offer For The Citi Prestige Credit Card (2020),” it was apparent that the best retention offer Citi had for me and my Citi Prestige card was no offer at all.

Why I Ditched The Citi Prestige And Went With The Citi Rewards+ Instead Of The Citi Double Cash Card

With that, I went back to my spreadsheet for one final analysis to decide if the Citi Prestige was worth keeping based on its ability to earn 5X Thank You points on restaurants while earning $5 off all Postmates orders over $25.

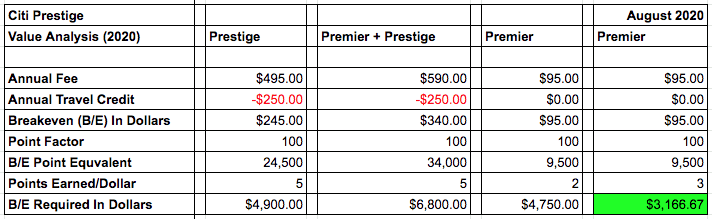

The Required Spending Breakeven Analysis

For this analysis, I was specifically looking at the breakeven point (B/E) in required spending on the card to zero out the cost of the annual fee(s).

Since I also hold the Citi Premier credit card, I ran 4 scenarios, the last being the Premier with the enhanced 3X earning (active in August 23, 2020).

Note: I did not factor in the savings of $5 per Postmates order over $25 because both the Prestige and Premier are World Elite Mastercards eligible for this benefit.

From this analysis, the clear winner is the new 3X enhanced Premier which would require an annual spending of just $3,166.67 to breakeven.

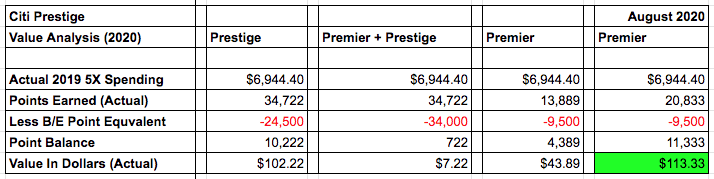

The Actual Spending Analysis [2019]

For this analysis, I took a look at my actual 5X restaurant spending in 2019.

In this scenario, the clear winner again was the new 3X enhanced Premier which would have gotten me $113.33 in value from my spending in 2019.

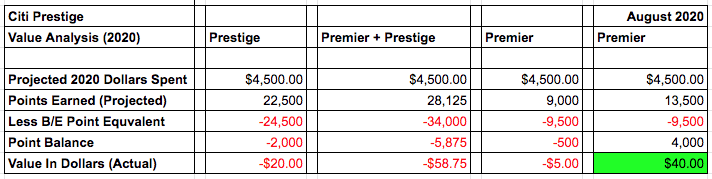

The Projected Spending Analysis [2020]

For my third and final analysis, I took a look at my projected spending for 2020-2021.

Considering the pandemic, I lowered my restaurant spending projection significantly over what I spent in 2019.

In this analysis, the winner was the 3X enhanced Premier yet again.

Based on my projected spending for the upcoming card member year, the 3X Premier is the only card that would give me a net positive in value ($40), and that is without the card’s ability to earn 5X Thank You points on restaurants while earning $5 off all Postmates orders over $25 factored in.

Time To Ditch The Citi Prestige For The Citi Double Cash Card, Right?

With the analysis complete, the decision was clear. It was time to finally ditch the Citi Prestige card.

In my prior post, I reported:

“I decided to ask what my downgrade options were, and [she] read through the predictable line of products including the Citi Preferred, Citi Premier (which I already held), and the Citi Rewards+. I asked if I could downgrade to the Citi Double Cash card, and she said, “yes”.”

From that lineup, the Citi Double Cash card stood out as the easy choice for a downgrade due to its ability to earn 2% cash back on all spending, and its ability to convert that 2% cash back into Thank You points.

Or so I thought.

When I attempted this downgrade, the Citi representative warned me that, “with this conversion, all of your current Thank You points will be immediately relinquished”.

“Wait, what!?”, I asked in horror.

“Yes, because you will be converting a “Thank You points product” to a “cash back product” all of your points earned on the Citi Prestige will be lost…unless you convert the Citi Prestige to another “Thank You points product”.

I forgot, with Citi not all Thank You points were created equal.

Time To Ditch The Citi Prestige For The Citi Rewards+

With my options for a downgrade conversion narrowed, there was only one real option for me, the Citi Rewards+ card due to its ability to earn 10% back on points redeemed (on the first 100,000 points).

That meant if I redeemed 100,000 points, I’d receive 10,000 points refunded back.

The Bottom-Line: Why I Ditched The Citi Prestige And Went With The Citi Rewards+ Instead Of The Citi Double Cash Card

In the end, I ditched the Citi Prestige for the Citi Rewards+ card (and it was an easy decision to make).

All three of my analyses showed the Citi Premier to be the card where I could best maximize my point earning based on my spending habits.

Moving forward, my strategy is to redeem all my Thank You points before April 10, 2021, the final date to still receive the 1.25 bonus on travel redemption with the Citi Premier.

If I can do that, I’ll also earn the extra 10,000 point refund courtesy of the Citi Rewards+ card.

Turns out, I won’t miss the Citi Prestige at all.