It’s been widely noted that earlier this week, Citi sent out surveys to some holders of the Citi Prestige card. Doctor of Credit has an extensive article covering the Prestige survey here.

It’s also no secret that Citi is likely looking to revamp the awards and benefits structure of both the Prestige and Premier cards for several reasons.

- The Competition: Citi devalued the Prestige card at precisely the “wrong time” – just as Chase was introducing its Sapphire Reserve card; even American Express revamped its Platinum Cards.

- The Devaluation: The Prestige devaluations included: The loss of the American Airlines Admiral’s club benefit, loss of the annual golf benefit, loss of the 1.33 Thank You Point redemption factor, and loss of the 1.6 Thank You point redemption factor when redeeming on American Airlines flights (among others).

- The Earning Structure: The “non-intuitive” earning of the Prestige and Premier cards: The Premier card actually has a better earning structure than the Prestige (by earning points in ‘Travel’ and ‘Gas’).

The Citi Premier Survey

What’s not been as widely noted, is that Citi has also sent out surveys to holders of the Citi Premier card.

The Citi Premier Survey Invitation:

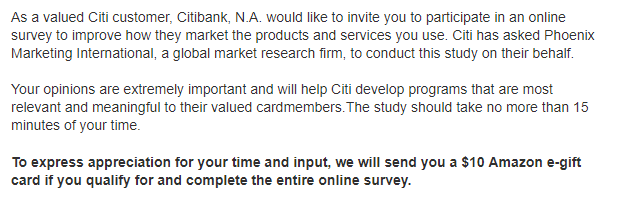

Here’s a copy of the survey email invite:

Some of the “Interesting” Citi Premier Survey Questions:

Interesting New Option #1: Earn 5x on dining. Yes, this would be a game changer. Moving the earning from 2x to the would-be “best in class” 5x is HUGE.

Interesting New Option #2: Round up every purchase. Again, game changer. Round up every purchase to the nearest twenty points ($3 coffee = 20 points). This seems way too generous, not sure how this could possibly work as you’d potentially be able to get 20x on a 25cent parking meter.

Interesting New Option #3: The 1.5 redemption factor: This would put Citi Thank You points on par with the best-in-class Chase Sapphire Reserve redemption factor of 1.5.

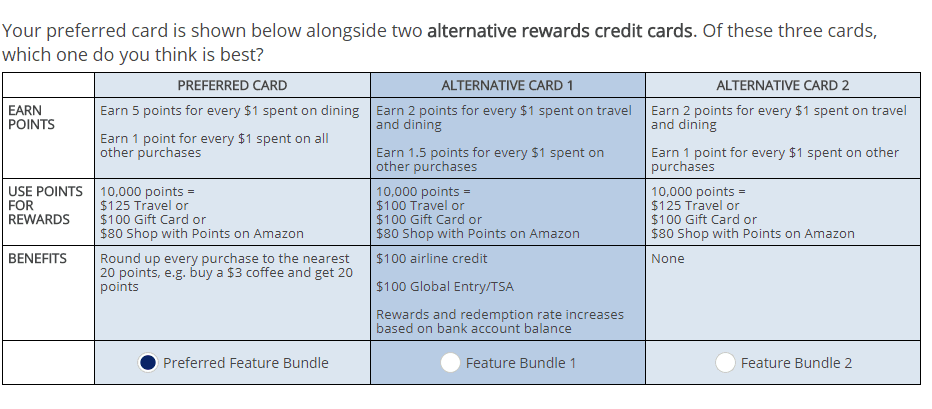

Interesting New Option #4: Earn 1.5x on all purchases. Earn 1.5x (like the Chase Freedom Unlimited), AND earn a 1.5 redemption (like the Chase Sapphire Reserve)? This is yet another “game changer”.

Interesting New Option #5: The $50 Credit. This looks like it may come in 3 options: Travel Service, Travel Credit, or Dining Credit. While not a game changer, this would be an awesome offset on the $95 Annual Fee of the Citi Premier Card.

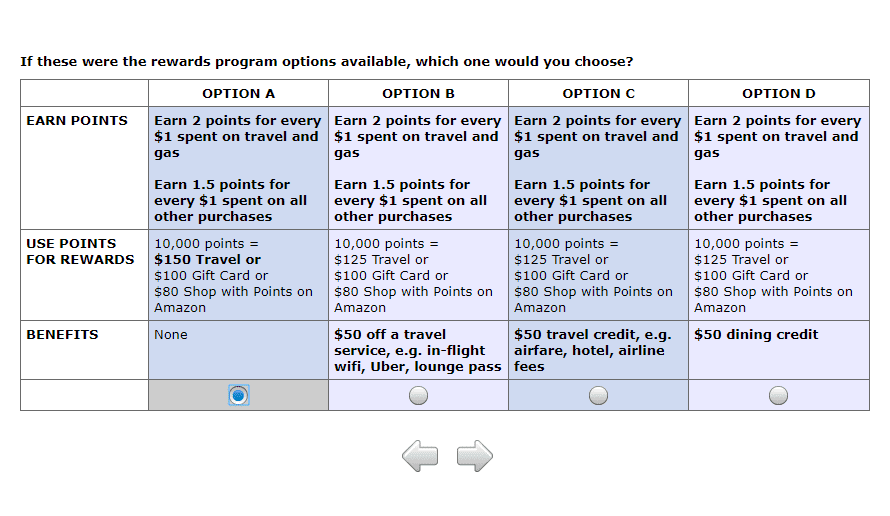

Interesting New Option #6: Spend 15K and earn either a) $30 off travel services, or b) 3K points. Although, this would not be a huge benefit in-and-of-itself, it would be a great benefit on top of 5x dining or 1.5 redemption.

The Bottom Line:

It’s very encouraging to see that Citi realizes that they have several issues with the Prestige and Premier cards that puts them at a major competitive disadvantage. It’s even more encouraging to see they are considering some very big new ideas that would be “game-changers” and ultimately achieve what Citi wants: to be your go-to wallet card for everyday spend.

Some of these ideas could go very far in achieving that. Let’s keep our fingers crossed.

Cheers!