Editors Note: This post is Part 5 of a 5 part series on the new Marriott and SPG merged loyalty program.

- Part 1: For Marriott Rewards Members: Everything You Need To Know About The Coming Merged Loyalty Program

- Part 2: For SPG Starwood Preferred Guest Members: Everything You Need To Know About The Coming Merged Loyalty Program

- Part 3: What You Need To Know About The Changes Coming To The Chase Marriott Suite Of Cards

- Part 4: What You Need To Know About The Changes Coming To The Chase Ritz-Carleton Cards

- Part 5: What You Need To Know About The Changes Coming To The American Express SPG Suite Of Cards

What You Need To Know About The Changes Coming To The American Express SPG Suite Of Cards

Just as Chase has done with the Chase Marriott Suite of Cards and the Chase Ritz-Carlton Rewards credit card, American Express is also changing their cards better align with the new merged loyalty program between Marriott and SPG.

The Starwood Preferred Guest Card From American Express

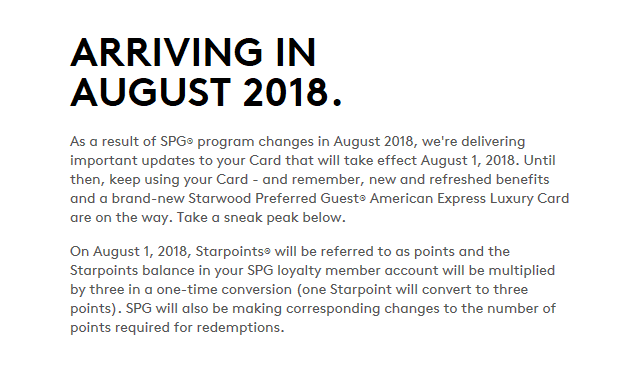

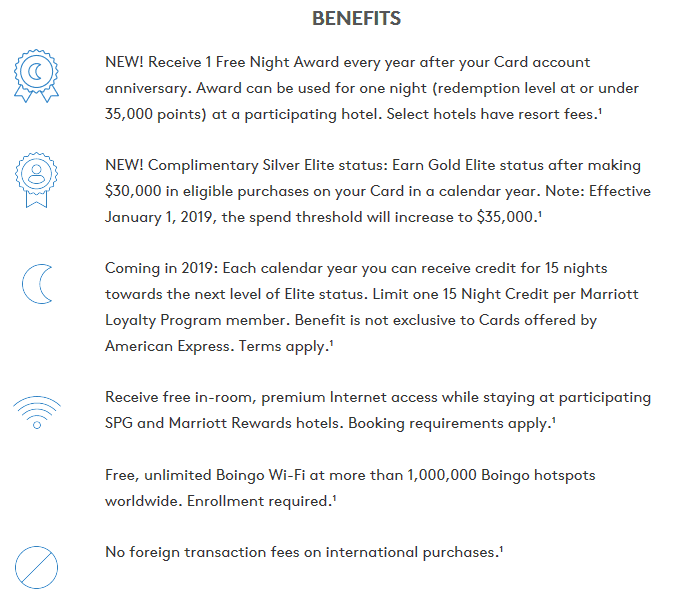

American Express is keeping the $95 annual fee “legacy” Starwood Preferred Guest card, but it is getting a “refresh” makeover.

The new earning structure will be 6X at SPG and Marriott Hotels and 2X everywhere else, meaning this card will earn the same 6X points as the other Chase Marriott and Chase Ritz-Carlton cards when used on Marriott and SPG properties.

Unfortunately, the 2X earning structure on this card for everything else is a 33% overall devaluation from it’s current earn rate of 1 Starwood point per dollar spent (which is currently equal to 3X Marriott points per dollar spent).

The Benefits

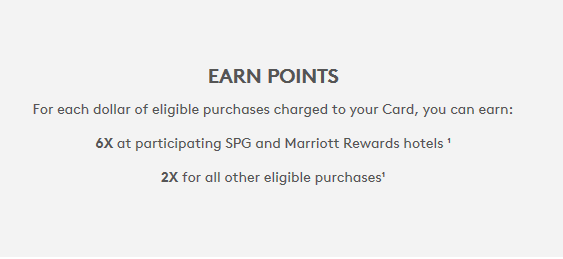

On the benefit side of things, we actually see a welcome upgrade as this card will now feature an annual free anniversary night on a hotel redemption up to 35,000 points.

Unfortunately, this card will no longer come with SPG Gold status, but will instead come with Silver Elite status in the new program (a major devaluation). However, there is still the path to earn Gold Elite status in the new program (which has been devalued as well) after spending $30,000 in 2018, or $35,000 annually in the years thereafter.

You will also receive 15 elite night credits which can get you closer to the all important Platinum Elite status that comes with free breakfast and lounge access. The other benefits of free premium wifi, Boingo wifi, and no foreign transaction fees will remain.

The Starwood Preferred Guest Business Card From American Express

Similar to the personal version, the The Starwood Preferred Guest Business Card will also see a refresh that comes with both major devaluations and a major upgrade.

What’s Changing:

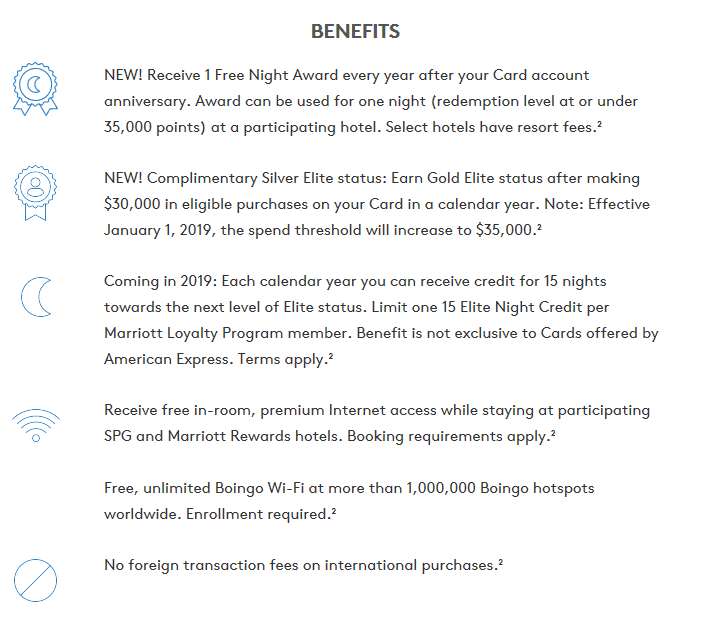

Like the personal card, the new earning structure will be 6X at SPG and Marriott Hotels and 2X everywhere else, but this card will also come with a 4X category at gas stations, restaurants, shipping, and wireless telephone services.

Unfortunately, the 2X earning structure on this card for everything else is a 33% overall devaluation from its current earn rate of 1 Starwood point per dollar spent (which is currently equal to 3X Marriott points per dollar spent).

The Benefits

On the benefit side of things, as with the personal card, we will see an upgrade as this card will now feature an annual free anniversary night on a hotel redemption up to 35,000 points.

But – and this is a big “but” – this card is losing its most beloved perk, the free access to Sheraton Club lounges. This was one of my favorite card perks of all.

Additionally, the business card will no longer come with SPG Gold status, but will instead come with Silver Elite status in the new program (a major devaluation). However, there is still the path to earn Gold Elite status in the new program (which has been devalued as well) after spending $30,000 in 2018, or $35,000 annually in the years thereafter.

You will also receive 15 elite night credits which can get you closer to the all important Platinum Elite status that comes with free breakfast and lounge access. The other benefits include free premium wifi, Boingo wifi, and no foreign transaction fees.

The Starwood Preferred Guest American Express Luxury Card

Until now, Chase was the only card issuer with a card for the luxury segment at Marriott and Ritz-Carlton resorts, the Chase Ritz-Carlton Rewards card.

Not to be outdone, American Express has just introduced their own luxury card, the aptly named Starwood Preferred Guest American Express Luxury Card.

Features Of The Luxury Card:

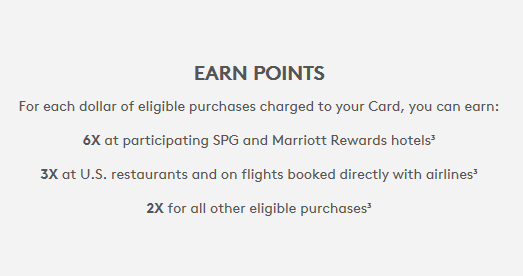

The luxury card comes with the new standard earning structure of 6X at Marriott and SPG properties, and 2X everywhere else. There is also a 3X earning category at restaurants and flights booked directly with airlines.

The Benefits

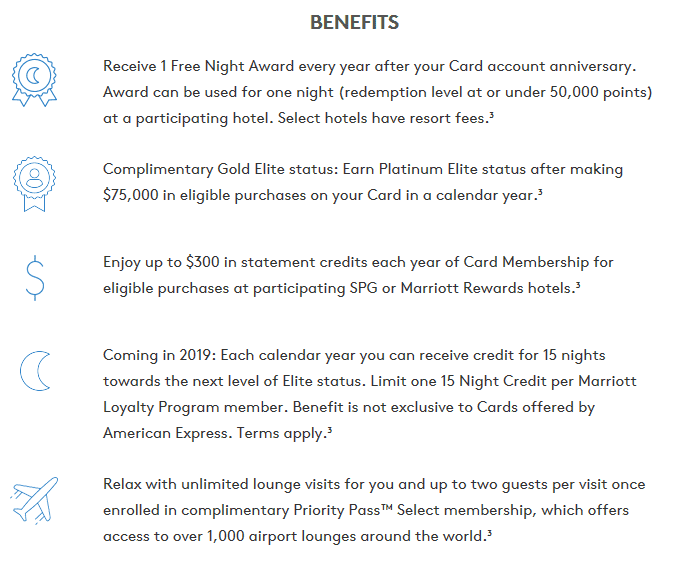

Like Chase’s luxury Marriott card, this card comes loaded with great benefits, many of them similar.

Benefits include an annual free anniversary night (up to 50,000 points), and a $300 statement credit for use at Marriott and SPG resorts (which is arguable better than the Ritz card’s $300 airline incidental credit that you have to call to get).

Additionally, the luxury card will come with Gold Elite status, with a path to earn Platinum Elite status after spending $75,000 in a calendar year. It is curious that American Express doesn’t give meaningful status on their luxury card being that they offer top Diamond status on the American Express Hilton Aspire luxury card – although that likely says more about Hilton and Marriott than anything else.

Other premium benefits include the standard obligatory luxury card benefits of a $100 Global Entry credit and Priority Pass membership.

You will also receive 15 elite night credits which can get you closer to the all important Platinum Elite status that comes with free breakfast and lounge access. The other benefits of free premium wifi, Boingo wifi, and no foreign transaction fees will remain.

The Bottom Line: What You Need To Know About The Changes Coming To The American Express SPG Suite Of Cards

For many people, myself included, the SPG Starwood Preferred Guest cards have been a favorite for non-bonused spend for many years. Sadly, the 33% loss in earning power on non-bonused is just too much to stomach. It’s likely these SPG cards will leave wallets in exodus and become “sock-drawer” cards for many people because the refreshed earning structure just doesn’t make sense to put much everyday spending on.

That, coupled with the loss of SPG Gold Status (now becoming the semi-worthless Silver Elite status) and the loss of the fan-favorite Sheraton Club access, means these cards no longer have much to offer other than the free night up to 35,000 (unless of course, if you are a hardcore Marriott or SPG road-warrior, in which case 6X points would come in handy).

In fairness, these American Express SPG cards are now pretty much on par with the Chase Marriott and Ritz-Carlton cards as far as earning, status, and benefits go. I think it just hurts worse because the SPG suite of cards were more valuable than the Marriott cards were up until now, and now they are all pretty much the same – relatively mediocre.

Whether you pick the Chase Marriott Rewards Premier Plus or the comparable American Express SPG preferred guest card, the Chase Ritz-Carlton or the comparable SPG Luxury card, most of the benefits and earning structures are the same. In the end, its a just matter of your personal preference. You can actually even have both the Amex and Chase cards – even if its just for the annual free nights.

Cheers!