This is another article in the “The best card for earning…” series where we analyze the best ways to earn your favorite points currencies. The previous Marriott Rewards article can be found here, and the previous SPG Starpoints article can be found here.

ABOUT HILTON HONORS POINTS:

Hilton Honors points are the currency of the popular hotel chain. The Hilton Honors program not only covers the namesake hotels, it also covers the properties of the Hilton portfolio – including some of the best hotels in the world like the Waldorf Astoria and Conrad.

There are many cards that can earn, transfer, or convert into Hilton Honors points. So what is the best choice?

WHAT YOU PROBABLY THINK:

(image courtesy of hilton.com)

METHODOLOGY:

To analyze this, I setup a hypothetical spending situation of $1,000 dollars. Next, I based the analysis on potential maximum spend – – the most you could earn on the card in the most lucrative category with the notable exception of actual Hilton hotel spending (which could earn an inordinate amount of points and result in a somewhat unrealistic analysis).

THE CONTENDERS:

THE ANALYSIS AND RESULTS:

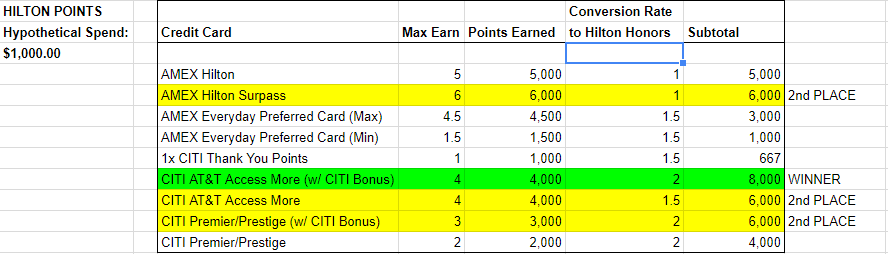

(The Results)

The above analysis takes into account both the regular Citi Transfer ratio of 1,000 Thank You points = 1,500 Hilton Honors, and the current Citi Thank You Bonus. For a limited time, the normal transfer ratio between Thank You points and Hilton Honors points of 1,000:1,500 Hilton Honors is boosted to the promotional ratio of 1,000:2,000.

Under the ‘Thank You point bonus’ scenario, the Citi AT&T Access More card easily wins. This card earns 3x Thank You points [in certain categories] and an additional 10,000 Thank You points when you spend $10,000 annually; bringing the average earned on this card to 4x (assuming $10,000 spend). Thus, on a $1,000 spend you can potentially earn 4,000 Thank You points; and the 4,000 Thank You points would transfer to 8,000 Hilton Honors points under the current promotion!

There was a tie for second place under the ‘Thank You point bonus’ scenario: The 3x earning Citi Prestige + Thank You bonus yielded 6,000 Hilton Honors points, as did the 6x earning American Express Hilton Surpass card.

If you take away the potential of the ‘Thank You point bonus’, there is another a tie. The Citi AT&T Access More card and the American Express Hilton Surpass card will each yield 6,000 Hilton Honors points on $1,000 worth of spend.

When deciding which card is best for you, be sure to take into account the $75 annual fee of the American Express Hilton Surpass card and the $95 annual fee of the [more flexible] Citi AT&T Access More card (my personal choice).

Cheers!