In a recent post, we speculated about the official changes Citi is bringing to their Citi Prestige Credit Card.

This morning, we got the full written confirmation from Citi via an email and a dedicated website. Here’s what you need to know.

What You Need To Know About The Official Changes Coming To The Citi Prestige Credit Card

Below is the official Citi email. Interestingly, Citi is not calling it a “refresh” or “reissue”, but rather a “redesign”.

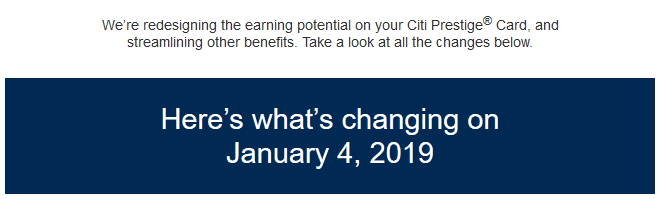

The Changes Effective January 4, 2019

As we talked about before, Prestige is adding an amazing 5x earning structure to the restaurants, air travel and cruise line categories. They are also keeping 3x on hotels but cutting the 2x on entertainment.

The Change Effective May 1, 2019

We got a better look at the cell phone protection benefit, but strangely, no hard details other than “assistance for damage or theft when you pay your monthly cellular bill with your card”.

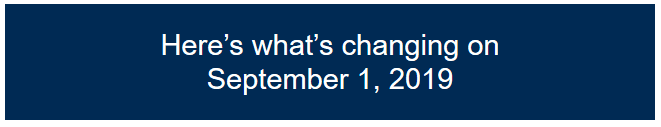

The Changes Effective September 1, 2019

As was discussed, the annual fee will increase from $450 to $495. The 4th night free benefit will be limited to 2 uses per year. Gone is the 25% more value on air fare benefit.

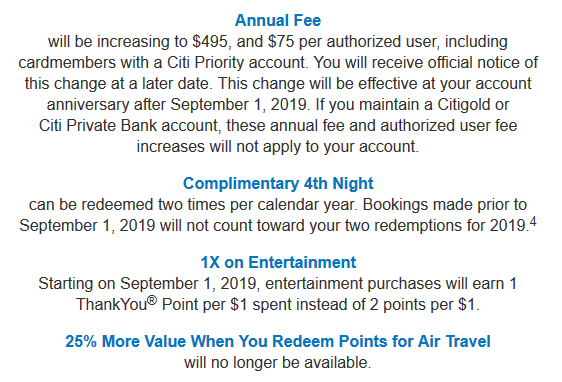

The Fine Print On The Changes To The 4th Night Free Benefit

We did see more important details about the 4th night free benefit in the fine print (see below). Basically, starting September 1, 2019, all 4th night free bookings must be made through thankyou.com or through 1-800-thankyou.

You’ll curiously no longer be able to book this through the Citi Prestige Concierge.

What Stays The Same

The Bottom Line: What You Need To Know About The Official Changes Coming To The Citi Prestige Credit Card

To see these newly released official details in their entirety, Citi has set up this page for the Citi Prestige redesign.

In the short term (January 4, 2019 through September 1, 2019), you may be able to wring some amazing value out of this card with 5x on certain categories and then cash that out at 25% more value.

This website does pretty much confirm what was speculated about many of the upcoming changes, as well as answer some hanging questions.

But it also neglects some of the most important details such as the exact dollar amount of the cell phone protection, future sign-up bonuses, and the all-important fate of the related Citi Premier card and it’s 25% more value benefit.

It still remains to be seen if this card is worth keeping in the long-term post September 1, 2019.

Cheers!